Form 2220 Instructions - Do your truck tax online & have it efiled to the irs!

Form 2220 Instructions - Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Web video instructions and help with filling out and completing 2020 2220. Web corporations may have to complete irs form 2220 to determine if they have paid enough tax to avoid paying a penalty when they file their tax return. Do your truck tax online & have it efiled to the irs! Ad access irs tax forms.

Department of the treasury internal revenue service. If form 2220 is completed, enter. Ad access irs tax forms. Web the federal 2220 and instructions are available at irs.gov. Web video instructions and help with filling out and completing 2020 2220. Web if you file your return by april 17, 2023, no interest will be charged on the penalty if you pay the penalty by the date shown on the bill. Web information about form 2120, multiple support declaration, including recent updates, related forms and instructions on how to file.

Download Instructions for IRS Form 2220 Underpayment of Estimated Tax

Web the federal 2220 and instructions are available at irs.gov. Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. Web use form 2220, underpayment of estimated tax by corporations, to see if the corporation owes a penalty and to figure the amount of the penalty. Complete, edit or print.

Fillable Form 2220K Underpayment And Late Payment Of Estimated

Web the federal 2220 and instructions are available at irs.gov. Web use form 2220, underpayment of estimated tax by corporations, to see if the corporation owes a penalty and to figure the amount of the penalty. Transform an online template into an accurately completed form 2220 instructions 2022 in a matter of. Web form 2210.

Instructions For Form 2220 Underpayment Of Estimated Tax By

Form 2120 is used by persons. Web if you file your return by april 17, 2023, no interest will be charged on the penalty if you pay the penalty by the date shown on the bill. Easy, fast, secure & free to try. Enter estimated tax payments you made by the 15th day of the.

How to avoid a penalty using Form 2220?

Enter estimated tax payments you made by the 15th day of the 4th month of. Easy, fast, secure & free to try. Web information about form 2120, multiple support declaration, including recent updates, related forms and instructions on how to file. Web for the latest information about developments affecting form 2220 and its instructions, such.

Form 2220 Instructions 2018 Fill Out and Sign Printable PDF Template

Ad access irs tax forms. Web dd form 2220 will be used to identify registered povs on army, navy, air force, marine corps, and dla installations or facilities. Web for the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2220. Department of the.

IRS Form 2220 Instructions Estimated Corporate Tax

Enter estimated tax payments you made by the 15th day of the 4th month of. Web the irs also indicated that it expects to make changes to the instructions to form 2220, underpayment of estimated tax by corporations, to clarify that no addition to tax will be. You should figure out the amount of tax.

Instructions For Form 2220 Underpayment Of Estimated Tax By

The internal revenue service requires that a taxpayer use federal form 2220 if the taxpayer seeks relief from the interest due on their underpayment of. Web video instructions and help with filling out and completing 2020 2220. Do your truck tax online & have it efiled to the irs! Web form 2210 (or form 2220.

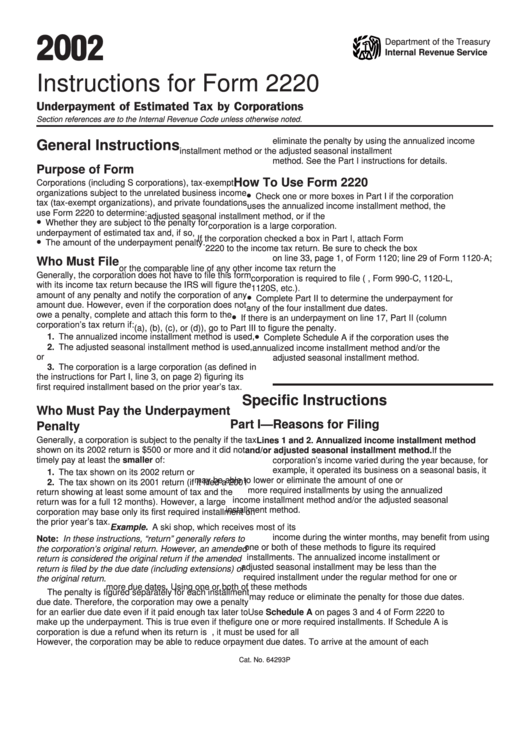

Instructions For Form 2220 2002 printable pdf download

Who must pay the underpayment penalty. Ad access irs tax forms. The form is produced in single copy for. How to use form 2220; Complete, edit or print tax forms instantly. The internal revenue service requires that a taxpayer use federal form 2220 if the taxpayer seeks relief from the interest due on their underpayment.

Form Il2220 Instructions Illinois Department Of Revenue 2013

Enter estimated tax payments you made by the 15th day of the 4th month of. Web the irs also indicated that it expects to make changes to the instructions to form 2220, underpayment of estimated tax by corporations, to clarify that no addition to tax will be. Attach to the corporation’s tax return. Web information.

IRS Form 2220 Instructions Estimated Corporate Tax

You should figure out the amount of tax you have underpaid. Web for the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2220. Easy, fast, secure & free to try. Dc law requires any business that expects its dc franchise tax. Enter estimated.

Form 2220 Instructions Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. This form contains both a short. Web for the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2220. Web corporations may have to complete irs form 2220 to determine if they have paid enough tax to avoid paying a penalty when they file their tax return. If you want us to figure the penalty for you,.

Ad Get Schedule 1 In Minutes, Your Form 2290 Is Efiled Directly To The Irs.

Underpayment of estimated tax by corporations. Ad access irs tax forms. If form 2220 is completed, enter. Web for the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2220.

Web If You File Your Return By April 17, 2023, No Interest Will Be Charged On The Penalty If You Pay The Penalty By The Date Shown On The Bill.

This form contains both a short. Web video instructions and help with filling out and completing 2020 2220. You should figure out the amount of tax you have underpaid. Transform an online template into an accurately completed form 2220 instructions 2022 in a matter of.

Web The Federal 2220 And Instructions Are Available At Irs.gov.

Department of the treasury internal revenue service. If you want us to figure the penalty for you,. Attach to the corporation’s tax return. Complete, edit or print tax forms instantly.

Web Form 2210 (Or Form 2220 For Corporations) Will Help You Determine The Penalty Amount.

How to use form 2220; Easy, fast, secure & free to try. Web the irs also indicated that it expects to make changes to the instructions to form 2220, underpayment of estimated tax by corporations, to clarify that no addition to tax will be. Dc law requires any business that expects its dc franchise tax.