Form 568 Single Member Llc - Pay the llc fee (if applicable) additionally, we.

Form 568 Single Member Llc - I (1) during this taxable year, did another person or legal entity acquire control or. Pay the llc fee (if applicable) additionally, we. Per the ca ftb limited liability. It should use the name and tin of. Web please remind your smllc clients that a disregarded smllc is required to:

I (1) during this taxable year, did another person or legal entity acquire control or. Pay the llc fee (if applicable) additionally, we. Web proseries basic doesn't support single member llcs. An llc can have as many members as it needs to. Web 3671203 form 568 2020 side 1 limited liability company return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership. Web form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or llc. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california.

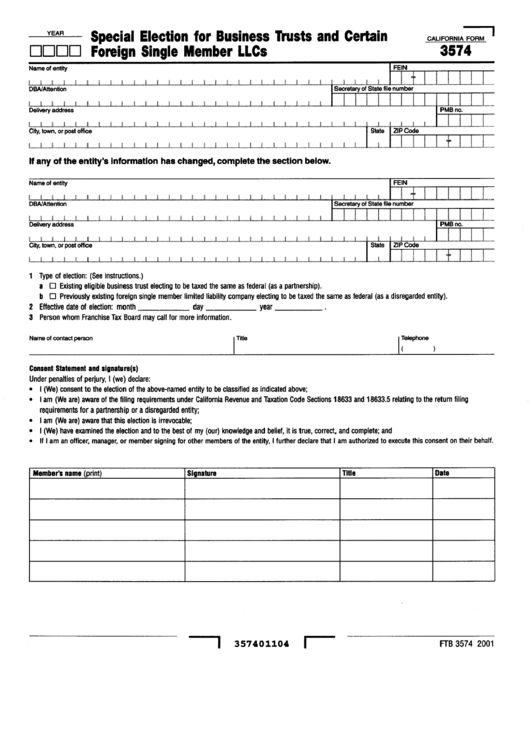

California Form 3574 Special Election For Business Trusts And Certain

Multiple member llcs must complete and. Web common questions about partnership ca form 568 for single member llcs. I (1) during this taxable year, did another person or legal entity acquire control or. The llc is doing business in california. The llc needs to file a 1065 partnership return and. Web 3671203 form 568 2020.

Form 568 2019 Fill Out, Sign Online and Download Fillable PDF

Web please remind your smllc clients that a disregarded smllc is required to: Form 568, limited liability company return of. Most states require the federal 1065 and state to be installed to access the smllc forms from the individual. It should use the name and tin of. Web an smllc consents to be taxed under.

Regarding California LLC formed Nov 2020, Form 568, EIN, Tax year 2020

Web proseries basic doesn't support single member llcs. Web 3671203 form 568 2020 side 1 limited liability company return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership. Solved • by intuit • 3 • updated 1 year ago. Web how to change a single.

Fillable Online ftb ca 2005 Limited Liability Company Return of

Web common questions about partnership ca form 568 for single member llcs. Multiple member llcs must complete and. Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: It should use the name and tin of. I (1) during this taxable year, did.

1998 form 568 Fill out & sign online DocHub

Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Web while a single member llc does not file california form 565, they must file california form 568 which provides details about the llc. Web proseries basic doesn't support single member llcs..

Form 568 Limited Liability Company Return of Fill Out and Sign

Web while a single member llc does not file california form 565, they must file california form 568 which provides details about the llc. It should use the name and tin of. Web please remind your smllc clients that a disregarded smllc is required to: Web common questions about partnership ca form 568 for single.

Regarding California LLC formed Nov 2020, Form 568, EIN, Tax year 2020

2021 limited liability company return of income. Web proseries basic doesn't support single member llcs. Web a single member limited liability company (smllc) is considered disregarded for federal income tax purposes. Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: Web while.

Form 568 Instructions 2022 State And Local Taxes Zrivo

Web please remind your smllc clients that a disregarded smllc is required to: Multiple member llcs must complete and. File a tax return (form 568) pay the llc annual tax. Pay the llc fee (if applicable) additionally, we. 2021 limited liability company return of income. Solved • by intuit • 3 • updated 1 year.

Regarding California LLC formed Nov 2020, Form 568, EIN, Tax year 2020

Web proseries basic doesn't support single member llcs. It should use the name and tin of. Web while a single member llc does not file california form 565, they must file california form 568 which provides details about the llc. Solved • by intuit • 3 • updated 1 year ago. File a tax return.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

Cohen, member joe stephenshaw, member 568 2022 limited liability company tax booklet this booklet contains: Web a single member limited liability company (smllc) is considered disregarded for federal income tax purposes. Web form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or llc. Solved •.

Form 568 Single Member Llc I (1) during this taxable year, did another person or legal entity acquire control or. Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: Llcs classified as a disregarded entity. Forbes™ can help you find the best llc provider for as little as $0 + state fees. Below are solutions to frequently.

Web While A Single Member Llc Does Not File California Form 565, They Must File California Form 568 Which Provides Details About The Llc.

Forbes™ can help you find the best llc provider for as little as $0 + state fees. Form 568, limited liability company return of. Solved • by intuit • 3 • updated 1 year ago. Web 3671203 form 568 2020 side 1 limited liability company return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership.

2021 Limited Liability Company Return Of Income.

Below are solutions to frequently. An llc can have as many members as it needs to. Ad 2023's best llc services that offer expert support & benefits. However, in california, smllcs are considered separate legal.

Web Please Remind Your Smllc Clients That A Disregarded Smllc Is Required To:

Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: File a tax return (form 568) pay the llc annual tax. The llc is organized in. Web how to change a single member llc to multi member:

Pay The Llc Fee (If Applicable) Additionally, We.

The llc is doing business in california. Web proseries basic doesn't support single member llcs. Web form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or llc. I (1) during this taxable year, did another person or legal entity acquire control or.