Form 941 Schedule B Instructions - 15, employer's tax guide, or section 8 of.

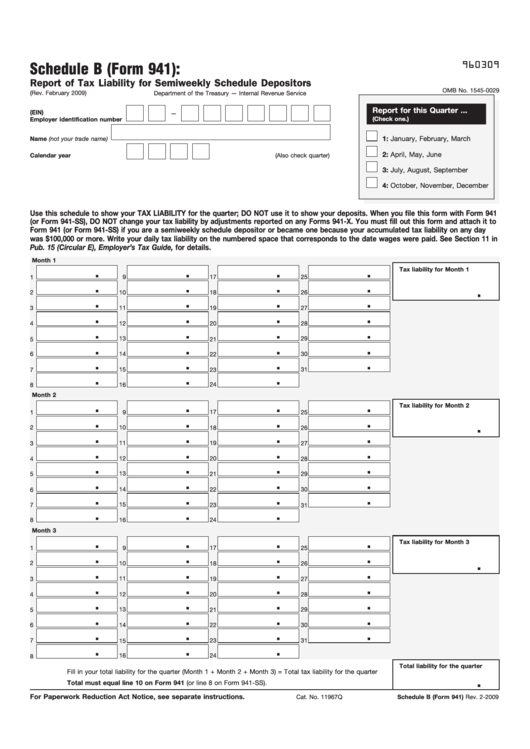

Form 941 Schedule B Instructions - Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Type or print within the boxes. Web you are required to file schedule b and form 941 by the last day of the month following the end of the quarter. Web schedule b is filed with form 941. Web inst 941 (pr) (schedule b) instructions for schedule b (form 941) (pr), report of tax liability for semiweekly schedule depositors (puerto rico version) 0323 03/01/2023.

1 number of employees who. 15, employer's tax guide, or section 8 of. Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Answer these questions for this quarter. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Fill in each fillable field. Web hit the get form option to begin editing and enhancing.

Schedule B Form 941 2022

15, employer's tax guide, or section 8 of. Web updated schedule b instructions were released. Web draft instructions for schedule b, report of tax liability for semiweekly schedule depositors, were updated with guidance about the end of the cobra. The instructions are to continue to be used with the january 2017 version of schedule b..

Download Instructions for IRS Form 941 Schedule B Report of Tax

At the time these instructions went to print, congress was. Web form 941 and its instructions, such as legislation enacted after they were published, go to irs.gov/form941. Web draft instructions for schedule b, report of tax liability for semiweekly schedule depositors, were updated with guidance about the end of the cobra. If you’re a monthly.

941 Form 2023

Web form 941 and its instructions, such as legislation enacted after they were published, go to irs.gov/form941. Switch on the wizard mode on the top toolbar to acquire more recommendations. In some situations, schedule b may be filed. Web schedule b is filed with form 941. Web form 941 (sch b) stephanie m dickson [email protected].

Instructions For Schedule B (Form 941) Report Of Tax Liability For

Web read the separate instructions before you complete form 941. Web here’s a simple tax guide to help you understand form 941 schedule b. Web you are required to file schedule b and form 941 by the last day of the month following the end of the quarter. Web use this schedule to show your.

IRS Instructions 941PR Schedule B 20202022 Fill and Sign

If you’re a monthly schedule. In some situations, schedule b may be filed. At the time these instructions went to print, congress was. Switch on the wizard mode on the top toolbar to acquire more recommendations. Don't use it to show your deposits. Employers are required to withhold. Web hit the get form option to.

941 Form 2023 schedule b Fill online, Printable, Fillable Blank

Web schedule b is filed with form 941. 15, employer's tax guide, or section 8 of. In some situations, schedule b may be filed. Web form 941 (sch b) stephanie m dickson [email protected] form 941 (sch d) shirley a draughn [email protected] form 941 (sch r) lori duenhoft. Web complete schedule b (form 941), report of.

941 form 2020 schedule b Fill Online, Printable, Fillable Blank

Therefore, the due date of schedule b is the same as the due date for the applicable form 941. To determine if you’re a semiweekly schedule depositor, see section 11 of pub. Web form 941 and its instructions, such as legislation enacted after they were published, go to irs.gov/form941. Web draft instructions for schedule b,.

Schedule B (Form 941) Report Of Tax Liability For Semiweekly Schedule

Web here’s a simple tax guide to help you understand form 941 schedule b. 15, employer's tax guide, or section 8 of. To determine if you’re a semiweekly schedule depositor, see section 11 of pub. In some situations, schedule b may be filed. Web you are required to file schedule b and form 941 by.

IRS Form 941 Schedule B 2023

Web you are required to file schedule b and form 941 by the last day of the month following the end of the quarter. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Web these instructions tell you about schedule b. Web use this.

941 Form 2022 schedule b Fill online, Printable, Fillable Blank

Web schedule b is filed with form 941. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Type or print within the boxes. 15, employer's tax guide, or section 8 of. Web complete schedule b (form 941), report of tax liability for semiweekly schedule.

Form 941 Schedule B Instructions Web these instructions tell you about schedule b. 1 number of employees who. Web use this schedule to show your tax liability for the quarter; Web if line 12 for the prior quarter was less than $2,500 but line 12 on this return is $100,000 or more, you must provide a record of your federal tax liability. Answer these questions for this quarter.

Answer These Questions For This Quarter.

Fill in each fillable field. Web form 941 and its instructions, such as legislation enacted after they were published, go to irs.gov/form941. If you’re a monthly schedule. Web you are required to file schedule b and form 941 by the last day of the month following the end of the quarter.

Therefore, The Due Date Of Schedule B Is The Same As The Due Date For The Applicable Form 941.

Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Employers are required to withhold. Web these instructions tell you about schedule b. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941.

Explore Instructions, Filing Requirements, And Tips.

At the time these instructions went to print, congress was. Web here’s a simple tax guide to help you understand form 941 schedule b. 1 number of employees who. 15, employer's tax guide, or section 8 of.

Web Schedule B Is Filed With Form 941.

Switch on the wizard mode on the top toolbar to acquire more recommendations. Web inst 941 (pr) (schedule b) instructions for schedule b (form 941) (pr), report of tax liability for semiweekly schedule depositors (puerto rico version) 0323 03/01/2023. Semiweekly schedule depositors must account for. Web use this schedule to show your tax liability for the quarter;