Tn Form Fae 173 - Web outside tennessee must prorate the franchise tax on the initial return from the date tennessee operations began.

Tn Form Fae 173 - Web click on the orange get form button to begin filling out. Get form now download pdf tennessee fae. Web the paper form fae173 is for taxpayers that meet an exception for filing electronically to remit a payment in person or through a mail service to meet the payment requirements to. This form is for income earned in tax year 2022, with tax. Web application for registration and instructions application for exemption/annual exemption renewal exempt entities application for exemption/annual exemption.

Get form now download pdf tennessee fae. Web fae 173 tennessee department of revenue application for extension of time to file franchise, excise tax file this form only if a payment is being made. Web application for registration and instructions application for exemption/annual exemption renewal exempt entities application for exemption/annual exemption. Go to the other > extensions worksheet. Web the paper form fae173 is for taxpayers that meet an exception for filing electronically to remit a payment in person or through a mail service to meet the payment requirements to. Web get fill in tennessee form fae 173 signed straight from your smartphone using these 6 tips: Web tennessee fae 173 form is a standardized test required to become licensed as a psychologist in the state of tennessee.

411 Tennessee Department Of Revenue Forms And Templates free to

Get form now download pdf tennessee fae. Go to the other > extensions worksheet. A taxable entity that is incorporated, domesticated,. Application for extension of time to file franchise and excise tax return you may file this extension along with your payment electronically at: Make sure to submit a tennessee extension payment with your request..

Tn Form Fae 183 Fillable Pdf Printable Forms Free Online

Make sure to submit a tennessee extension payment with your request. Franchise and excise tax application for exemption/annual exemption renewal. Web taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date tennessee operations began,. A taxable entity that is incorporated, domesticated,. Easily.

tn franchise and excise tax mailing address Blimp Microblog Custom

Web the paper form fae173 is for taxpayers that meet an exception for filing electronically to remit a payment in person or through a mail service to meet the payment requirements to. Enter signnow.com in the phone’s browser and log in to your profile. Application for extension of time to file franchise and excise tax.

TN DoR FAE 173 2017 Fill out Tax Template Online US Legal Forms

Web fae 173 tennessee department of revenue filing period account fae 173 application for extension of time to file franchise, excise tax an extension of time of. Federal input notes and features for fae 170 and fae 174 fs codes. Web get fill in tennessee form fae 173 signed straight from your smartphone using these.

Oregon dmv form 735 173 instructions Fill out & sign online DocHub

Web date tennessee operations began (see instructions) fein. Web fae 173 tennessee department of revenue application for extension of time to file franchise, excise tax file this form only if a payment is being made. Get form now download pdf tennessee fae. Web fae 173 tennessee department of revenue filing period account fae 173 application.

Form Fae 173 ≡ Fill Out Printable PDF Forms Online

Web the paper form fae173 is for taxpayers that meet an exception for filing electronically to remit a payment in person or through a mail service to meet the payment requirements to. If you don’t have an. Web fae 173 tennessee department of revenue filing period account fae 173 application for extension of time to.

Form RVR0006201 (FAE176) Download Printable PDF or Fill Online

Web outside tennessee must prorate the franchise tax on the initial return from the date tennessee operations began. Go to the other > extensions worksheet. Web the paper form fae173 is for taxpayers that meet an exception for filing electronically to remit a payment in person or through a mail service to meet the payment.

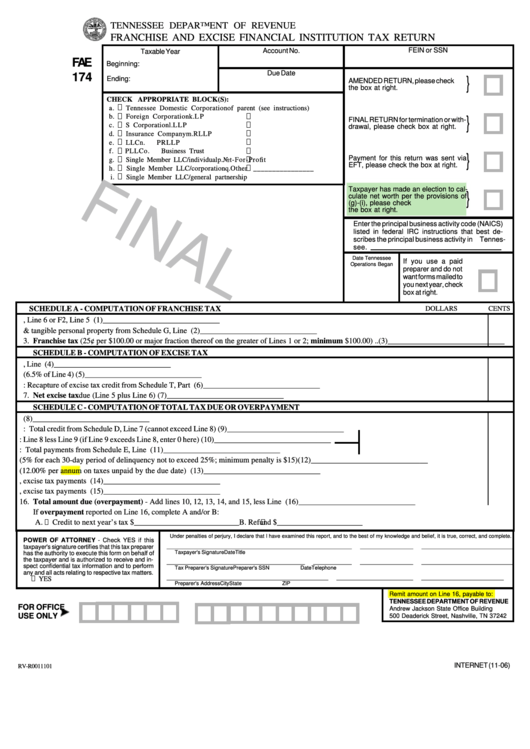

Form Fae 174 Franchise And Excise Financial Institution Tax Return

Web date tennessee operations began (see instructions) fein sos control number taxpayer's signature date title tax preparer's signature preparer's ptin date telephone. Web the paper form fae173 is for taxpayers that meet an exception for filing electronically to remit a payment in person or through a mail service to meet the payment requirements to. Web.

Form Fae 161 Franchise, Excise Tax Return (Short Form) printable pdf

Save or instantly send your ready documents. Enter signnow.com in the phone’s browser and log in to your profile. Web how do i generate the fae 173 for a tennessee corporation using worksheet view? Franchise and excise tax application for exemption/annual exemption renewal. This form is for income earned in tax year 2022, with tax..

Fillable Form Fae 173 Application For Extension Of Time To File

Franchise and excise tax application for exemption/annual exemption renewal. Application for extension of time to file franchise and excise tax return you may file this extension along with your payment electronically at: Federal input notes and features for fae 170 and fae 174 fs codes. Web fae 173 tennessee department of revenue application for extension.

Tn Form Fae 173 Go to the other > extensions worksheet. Get form now download pdf tennessee fae. Federal input notes and features for fae 170 and fae 174 fs codes. Activate the wizard mode on the top toolbar to acquire extra suggestions. 15th day of the fourth, sixth, and ninth months of the current tax year.

This Form Is For Income Earned In Tax Year 2022, With Tax.

Make use of the tips on how to fill out the tn dor fae. 15th day of the fourth, sixth, and ninth months of the current tax year. Go to the other > extensions worksheet. Web tennessee form fae 170, page 1, is then prepared and a minimum franchise tax of $100 is computed.

Web Fae 173 Tennessee Department Of Revenue Filing Period Account Fae 173 Application For Extension Of Time To File Franchise, Excise Tax An Extension Of Time Of.

Web application for registration and instructions application for exemption/annual exemption renewal exempt entities application for exemption/annual exemption. Make sure the info you fill. Enter signnow.com in the phone’s browser and log in to your profile. Activate the wizard mode on the top toolbar to acquire extra suggestions.

Web Get Fill In Tennessee Form Fae 173 Signed Straight From Your Smartphone Using These 6 Tips:

Web outside tennessee must prorate the franchise tax on the initial return from the date tennessee operations began. Web the paper form fae173 is for taxpayers that meet an exception for filing electronically to remit a payment in person or through a mail service to meet the payment requirements to. Application for extension of time to file franchise and excise tax return you may file this extension along with your payment electronically at: Web tennessee fae 173 form is a standardized test required to become licensed as a psychologist in the state of tennessee.

Save Or Instantly Send Your Ready Documents.

Web how do i generate the fae 173 for a tennessee corporation using worksheet view? Web fae 173 tennessee department of revenue application for extension of time to file franchise, excise tax file this form only if a payment is being made. Federal input notes and features for fae 170 and fae 174 fs codes. Web taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date tennessee operations began,.